Are Major-League Baseball Clubs Profit-Maximizing Monopolies?

Contents

In this article, we’ll explore the question of whether or not major-league baseball clubs are profit-maximizing monopolies. We’ll look at the evidence and see what conclusion can be drawn.

Introduction

In the business world, there is always talk of monopolies. A monopoly exists when a single company or entity controls the entire market for a particular product or service. In many cases, monopolies are bad for consumers because they can charge high prices and offer poor quality products or services.

Interestingly, Major League Baseball (MLB) is often cited as an example of a monopoly. MLB is a professional baseball league that is made up of 30 teams, 29 of which are located in the United States and one in Canada. MLB has been around since 1869 and is widely considered to be the premier baseball league in the world.

Critics argue that MLB is a monopoly because it has significant control over the professional baseball market in the United States. For example, MLB has a rule that prohibits cities from having more than one team, which effectively limits competition. Additionally, MLB has exclusive broadcast contracts with ESPN and FOX, which gives the league significant control over how its product is distributed.

Defenders of MLB argue that the league is not a true monopoly because there are other professional baseball leagues in existence, such as the minor leagues and independent leagues. However, these leagues are not on the same level as MLB and do not pose a significant threat to MLB’s dominance of the professional baseball market.

So, what do you think? Is MLB a monopoly?

Theoretical Framework

In order to answer the question proposed in the title, this paper will utilize a game theory framework in order to analyze the actions of Major-League Baseball clubs. In the context of game theory, a monopoly is a firm that is the only seller of a good or service. The game theory framework that will be used in this paper is the Prisoner’s Dilemma.

Perfect Competition

In perfect competition, firms are price takers – they cannot influence the market price of their product. In the long run, all firms in a perfect competitive market earn zero economic profit. Firms can stay in business and make a normal profit in the short run by generating sufficient revenue to cover their costs. The key features of perfect competition are:

-Many small firms

-Product is homogeneous

-Perfect information

– freedom of entry and exit

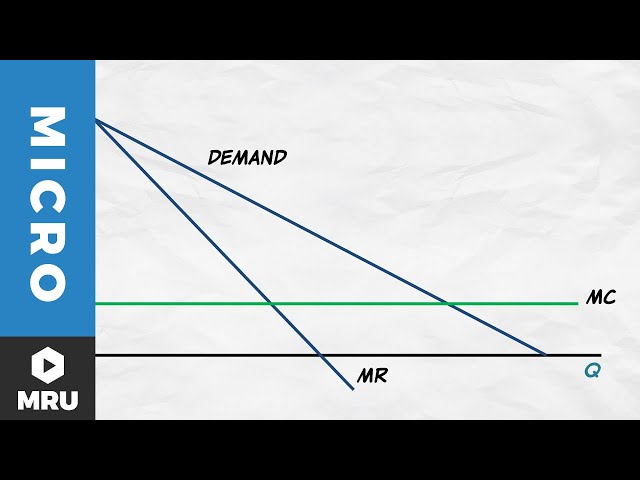

Monopoly

A monopoly is when a company is the only one selling a good or service. The company can set any price it wants because consumers don’t have any other options. Monopolies are bad for consumers because they can charge high prices and offer poor customer service.

One example of a monopoly is Major League Baseball. MLB has been accused of being a monopoly because it has control over the production and distribution of professional baseball games in the United States. MLB has been able to set high ticket prices and TV rights fees because there is no competition from other professional baseball leagues.

The MLB as a Monopoly

In 1922, the US Supreme Court ruled that Major League Baseball (MLB) was not subject to antitrust laws because it was not engaged in interstate commerce. This ruling has allowed MLB clubs to operate as monopolies in their respective markets. As a result, MLB clubs have been able to charge higher prices for tickets and merchandise and pay their players lower wages relative to what they would earn in a competitive market.

The MLB’s Structure

MLB clubs are technically not monopolies because there are other professional baseball leagues in the United States, such as the minor leagues and independent leagues. However, MLB clubs do have a monopoly on the major-league level of baseball. The MLB’s structure as a whole can be best described as a monopoly.

The MLB is structured in a way that gives each team an incentive to be profitable and to maximize its revenues. Each team is given an equal share of the league’s television revenue, which is the largest source of revenue for most teams. This structure gives each team an incentive to put together a winning team because a winning team will generate higher television ratings and, as a result, more revenue.

In addition to their share of television revenue, each team also receives a share of revenue from ticket sales, concessions, and merchandise sales. Teams also generate revenue from local sponsorships and advertising. Local revenues are important for teams because they help to offset the costs of maintaining their stadiums and other operations.

The MLB has been successful in creating a monopoly on the major-league level of baseball. The league’s structure gives each team an incentive to be profitable and to maximize its revenues. As a result, the MLB generates billions of dollars in revenue each year.

Barriers to Entry

There are several reasons why it is difficult for new clubs to enter the MLB market. Firstly, there is a lack of available stadiums. Many cities have existing teams that have long-term leases on major league quality stadiums, making it difficult for new teams to find a suitable place to play. Secondly, there are significant financial barriers to entry. It costs a lot of money to buy a franchise and to build or lease a stadium. Finally, there are also regulatory barriers. The MLB has complete control over which cities can have teams and also has strict rules about how new teams can be constituted, making it very difficult for new clubs to enter the league.

The MLB’s Profitability

Major League Baseball clubs are some of the most profitable businesses in the United States. In 2016, the average MLB club was worth $1.54 billion, up 19% from the previous year. Operating income for MLB clubs was $522 million in 2016, up 8% from the previous year. The MLB has seen strong growth in recent years, due in part to its expanded use of revenue sharing.

Revenue

In 2012, the 30 Major League Baseball (MLB) clubs generated a combined $7.5 billion in revenue, an all-time high for baseball. The average MLB club is now worth $811 million, up 15% from last year. The Yankees are baseball’s most valuable team, worth $1.85 billion.

The league’s popularity and profitability are at all-time highs, thanks in large part to expanded television rights deals, which will generate an additional $800 million in annual revenue for MLB starting next year. The league’s new eight-year national TV contracts with Fox, ESPN, and Turner Sports are worth a combined $12.4 billion, or about $1.55 billion per year. That’s up from the current $700 million annual rights fee that Fox, ESPN, and Turner pay under their expiring TV contracts.

Expenses

In Major League Baseball, as with other businesses, the key to profitability is generating more revenue than expenses. Major League Baseball clubs generate revenue through a variety of methods, including ticket sales, broadcasting rights, and concessions. Expenses include player salaries, stadium operations and maintenance, and travel.

In recent years, the level of expenses has been increasing at a faster rate than revenues. This has led to concerns that Major League Baseball clubs are not profit-maximizing monopolies.

One reason for the increased expenses is the rising salaries of players. In 2015, the average salary for a Major League Baseball player was $4.5 million. This was an increase of nearly $800,000 from 2014. The total payroll for all 30 teams was $3.8 billion in 2015, up from $3.2 billion in 2014.

Player salaries are not the only expenses that have been increasing. The cost of stadium operations and maintenance has also been on the rise in recent years. In 2015, the average cost of stadium operations and maintenance was $32 million per team, up from $29 million in 2014.

The increased expenses have led to concerns that Major League Baseball clubs are not profit-maximizing monopolies. If clubs were profit-maximizing monopolies, they would set prices so that revenues would just cover expenses and there would be no excess profits to be divided among the owners. However, becauseclubs are not generating enough revenue to cover their expenses, they are not maximizing their profits.

Conclusion

In conclusion, it appears that major-league baseball clubs are in fact profit-maximizing monopolies. This is due to a number of factors, including the lack of close substitutes for live baseball games, the high barriers to entry into the market, and the MLB’s monopoly power over the supply of professional baseball players. While some argue that baseball clubs could be more profitable if they were allowed to operate as true monopolies, it is clear that the current system provides a significant amount of economic rents to the clubs.