Does the NFL Pay Taxes?

Contents

The National Football League is a tax-exempt nonprofit organization. Find out why and how the NFL pays taxes.

What is the NFL?

The NFL is a 501(c)(6) tax-exempt, nonprofit trade association formed in 1920. As a membership organization, it is exempt from paying federal income taxes on the money it generates from selling broadcasting rights, ticket sales and other sources.

What is the NFL’s tax status?

The National Football League is a 501(c)(6) non-profit trade association. As such, it is exempt from federal taxation on income. The NFL’s tax-exempt status was confirmed by a ruling from the United States Court of Appeals in 1966.

The NFL’s primary income comes from three sources: television rights fees, ticket sales, and merchandise sales. The vast majority of the NFL’s revenue is generated by television rights fees. In 2016, the NFL generated $7.8 billion in revenue from television rights fees. Of that $7.8 billion, $5.6 billion came from national television contracts and $2.2 billion came from local television contracts.

The NFL does pay taxes on some of its income. For example, the NFL pays taxes on ticket sales and merchandise sales. The NFL also pays taxes on income that is not related to its operations, such as investment income and income from real estate holdings.

How much money does the NFL make?

How much money does the NFL make?

The NFL is a 501(c)(6) tax-exempt organization.1 That means it doesn’t have to pay federal corporate income taxes on the money it takes in. The league does, however, pay taxes on its investment income.2 Forbes estimates the NFL’s annual revenue at $13 billion.3

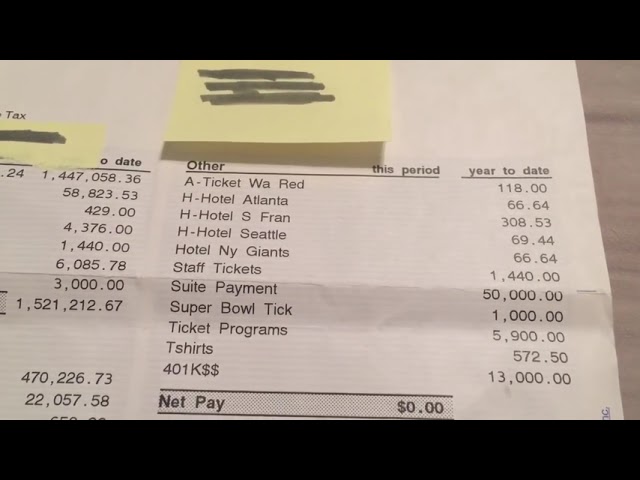

The NFL isn’t required to disclose how much money it makes, but a leaked financial document from 2010 showed that the league took in $9.3 billion in revenue that year.4 Of that, $1.3 billion came from broadcast rights, $1.2 billion came from ticket sales, and $800 million came from licensed merchandise sales. The document showed that the league had expenses of $6 billion, which included player salaries and benefits ($3 billion) and other operating expenses ($2.7 billion). That left the NFL with a profit of $3 billion for the year.

How much money does the NFL pay in taxes?

The NFL is a tax-exempt 501(c)(6) organization. That means it doesn’t have to pay federal taxes on its income. The league does, however, pay taxes on some of its entities, such as its broadcast network and merchandise sales.

The NFL brought in a reported $13 billion in revenue in 2017, the most recent year for which financial data is available. That same year, the league paid $109 million in federal taxes, according to documents obtained by Forbes.

The vast majority of the NFL’s revenue comes from broadcast rights fees and advertising. Its broadcasts are seen by millions of people every week, making it one of the most popular television programs in the country. The league also generates revenue from ticket sales and merchandise sales.

While the NFL does not have to pay federal taxes, it does pay state and local taxes. In 2017, the league paid $6 million in state and local taxes, according to Forbes.

How does the NFL’s tax status impact its players and fans?

The National Football League (NFL) is a tax-exempt, not-for-profit organization. That means it doesn’t have to pay federal income taxes on the money it brings in through things like ticket sales, television contracts, and merchandise sales. The NFL’s tax exempt status has come under fire in recent years, with some critics arguing that the league should have to pay taxes like other for-profit businesses.

The NFL’s tax exempt status does not mean that it doesn’t pay any taxes at all. The league does pay some state and local taxes, as well as property taxes on its headquarters and stadium buildings. And while the NFL itself is exempt from federal income taxes, its players and employees are not. So while the NFL itself may not be paying taxes, the people who work for the league are paying their share.

The debate over whether or not the NFL should have to pay federal income taxes is unlikely to be resolved anytime soon. But one thing is certain: if the league were to lose its tax exempt status, it would be a huge financial blow to the organization.