Is WWE a Good Stock to Buy?

Contents

If you’re wondering whether WWE is a good stock to buy, you’re not alone. Many investors are intrigued by the company’s strong performance in recent years and its potential for continued growth. However, there are also some risks to consider before making an investment.

WWE’s Business Model

WWE is a publicly traded company with the ticker symbol WWE. The company is a entertainment company that produces television programming, live events, and digital content. WWE is a part of the entertainment industry, which is made up of other companies such as Netflix, Walt Disney, and Comcast. The entertainment industry is a cyclical industry, which means that it goes through periods of highs and lows.

Live events

A key part of WWE’s business model is live events. WWE stages over 500 live events a year, including WrestleMania, which is its premier annual event.

Live events are a significant source of revenue for WWE. In 2018, live events generated $172 million, or 26% of WWE’s total revenue. That was up from $156 million, or 25% of the company’s total revenue, in 2017.

WWE has been able to grow its live event revenue in recent years by staging more international events. In 2018, international live events accounted for $77 million, or 45% of WWE’s total live event revenue. That was up from $60 million, or 38% of the company’s total live event revenue, in 2017.

The company has also been able to grow its ticket prices. The average ticket price for a WWE event was $61 in 2018, up from $58 in 2017.

WWE’s growth in live event revenue has helped offset declines in other areas of its business. For example, while WWE’s TV rights fees have increased in recent years, its TV ratings have declined.

Media (television and digital)

In terms of its business model, WWE is a entertainment company that primarily generates revenue through the sale of its live and recorded entertainment products (television and digital), through the sale of licensed products, and through fees associated with the live events it produces.

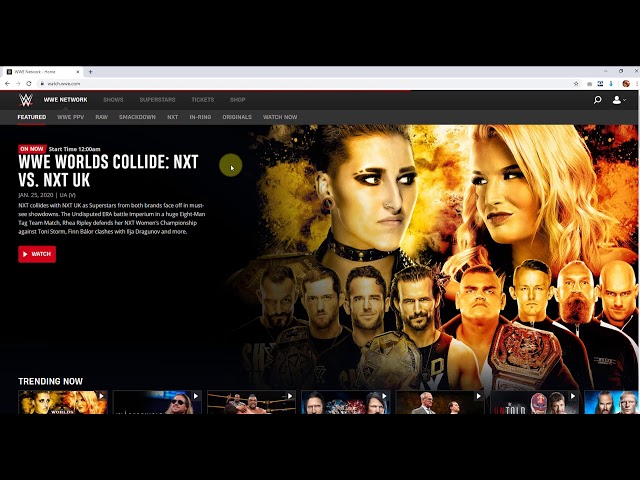

WWE’s core product is professional wrestling, which it produces for television and digital media. WWE currently broadcasts live programming 52 weeks per year to a global television audience. In 2017, WWE’s flagship programs, Raw and SmackDown Live, averaged 3.6 million and 2.5 million viewers, respectively, across all airings on USA Network. In addition to these programs, WWE produces pay-per-view events throughout the year as well as other annual special programming. In 2017, WWE’s four largest pay-per-view events (Royal Rumble, WrestleMania, SummerSlam, and Survivor Series) generated 1.2 million buys globally on traditional pay-per-view channels and an additional 1.1 million buys via our over-the-top digital platforms.

Licensing

WWE’s content is currently distributed on a variety of platforms in over 180 countries. WWE’s content licensing business has several direct distribution agreements, as well as numerous agreements with television networks and digital platform providers around the world.

In the United States, WWE’s flagship programs, Raw and SmackDown, air live each week on the USA Network. USA Network is a top-rated cable network and is a part of NBCUniversal’s portfolio of cable networks. In addition to Raw and SmackDown, USA Network also airs WWE NXT, Live from Madison Square Garden,205 Live, Total Divas and Total Bellas. USA Network is available in approximately 85 million homes in the United States.

WWE also has agreements with several digital platform providers, including Hulu, Amazon Video, Google Play and iTunes. In addition, WWE has direct to consumer streaming service – WWE Network – which is available in over 180 countries.

WWE’s Financials

WWE is a publicly traded company on the New York Stock Exchange (NYSE) under the ticker symbol WWE. As of 2020, WWE’s market cap is $2.24 billion. The company has been growing at a steady pace over the past few years. In 2019, WWE’s revenue was $279 million, which was an 8% increase from the previous year. Let’s take a look at WWE’s financials to see if it is a good stock to buy.

Revenue and profit

Revenue and profit are two important financial indicators of a company’s health. They are often used to measure a company’s performance and make decisions about whether or not to invest in it.

WWE is a publicly-traded company, meaning that its financial information is available to the public. In 2018, WWE reported revenue of $265.9 million and net income of $32.0 million. This means that for every dollar of revenue that WWE generates, it keeps about 12 cents as profit.

While WWE’s profit margin is not extraordinarily high, it is still higher than the average for publicly-traded companies, which was about 7% in 2018. This indicates that WWE is relatively efficient at generating profit from its revenue.

Investors often use a company’s revenue and profit growth as indicators of its future potential. Over the past five years, WWE’s revenue has grown at an average annual rate of 5.4%. Its net income has grown at an even higher rate of 9.7% per year on average over the same period. This indicates that WWE has been consistently growing its top and bottom lines over time, which is generally seen as a positive sign by investors.

Debt

As of June 30th, WWE had $29 million in cash and equivalents and $265 million in long-term debt. The company’s total debt has actually decreased by $41 million over the last year. In terms of its debt-to-equity ratio, WWE came in at 1.4x as of its most recent quarterly filing. This is an improvement from the 1.6x ratio reported at the end of last year.

WWE’s Stock

WWE is a publicly traded company and as of June 2020, their stock is $43.03 per share. The company has been growing steadily over the past few years and their quarterly revenue is up. WWE has a lot of potential and is a good stock to buy.

Price history

WWE’s stock price history is as follows:

-In October 1999, WWE’s stock was first offered to the public at $17 per share.

-In March 2000, WWE’s stock reached its all-time high of $32 per share.

-In November 2001, following the9/11 terrorist attacks and the collapse of the dot-com bubble, WWE’s stock plummeted to a low of $6 per share.

-In May 2002, WWE was added to the Standard & Poor’s SmallCap 600 Index.

-In June 2003, WWE completed a 1-for-4 reverse split of its common stock.

-In February 2014, WWE’s stock reached an all-time high of $32.87 per share.

-On July 9, 2018, it was announced that WWE had been added to the S&P MidCap 400 Index.

Analyst ratings

WWE has been the subject of a number of research analyst reports. ValuEngine lowered WWE from a “buy” rating to a “hold” rating in a research note on Tuesday, February 20th. BidaskClub lowered WWE from a “hold” rating to a “sell” rating in a research note on Saturday, December 2nd. Loop Capital lowered their price objective on WWE from $32.00 to $27.00 and set a “buy” rating for the company in a research note on Wednesday, October 18th. Finally, Zacks Investment Research raised WWE from a “sell” rating to a “hold” rating in a research note on Tuesday, January 16th. Five investment analysts have rated the stock with a sell rating, eight have issued a hold rating and three have given a buy rating to the company’s stock. WWE presently has an average rating of “Hold” and an average target price of $27.97.

Risks and Opportunities

WWE is a publicly traded company with a market capitalization of over $2 billion. The company’s stock has been on a tear lately, rising over 50% in the past year. WWE has been successful in monetizing its content through a variety of channels, including TV rights, live events, and its new WWE Network. WWE’s business appears to be firing on all cylinders, but there are a few risks investors should be aware of before buying the stock.

Risks

WWE is a publicly traded company, and as such, it is subject to certain risks. These risks include, but are not limited to, the following:

-Changes in the tastes of the general public: WWE’s products are largely dependent on public taste. If the public’s taste in entertainment changes, WWE could be negatively affected.

-Changes in the preferences of key demographic groups: WWE’s products are aimed at a specific demographic group – namely, young men aged 18-34. If this demographic group’s preferences change, WWE could be negatively affected.

-Economic conditions: WWE’s products are discretionary items, which means that they are likely to be among the first items that consumers cut back on when economic conditions deteriorate. This could have a negative impact on WWE’s business.

-Competition: WWE faces significant competition from other entertainment companies, such as Netflix and Disney. If these companies are able to capture a larger share of the market, it could negatively impact WWE.

Opportunities

WWE has a new CEO, Vince McMahon. He founded the company in 1980, taking it public in 1999.

In February 2018, McMahon announced he was relaunching the XFL, a professional football league that previously ran for one season in 2001. The new league is scheduled to start in 2020.

In September 2018, WWE launched a new TV deal with Fox Sports worth $1 billion. The five-year deal will see WWE programming air on Fox’s cable channels (Fox Sports 1 and Fox Deportes) and on the Fox broadcast network.

In January 2019, WWE signed a 10-year deal with Comcast worth $265 million. The deal will see WWE’s flagship shows Raw and Smackdown move from USA Network to Comcast’s NBCUniversal Channel beginning in October 2019.